The real estate market is always changing, but some types of properties remain solid investments year after year. In 2023, these four commercial real estate investments in Vancouver are poised to deliver the highest returns for investors:

Multifamily Properties

Multifamily properties including apartment buildings, duplexes, and apartment complexes have long been favored by real estate investors. The primary advantage of multifamily properties is the ability to generate rental income from multiple units, which helps cover mortgage payments and operating expenses. Additionally, having multiple units reduces the impact of vacancy compared to a single-family rental.

When evaluating a multifamily purchase, pay close attention to the capitalization rate, current rental rates compared to the broader market, and the condition of the property. Look for buildings that need modest upgrades like kitchen renovations and flooring replacement that will allow you to increase rents. Properties near public transportation and employment hubs also make the units easier to keep occupied.

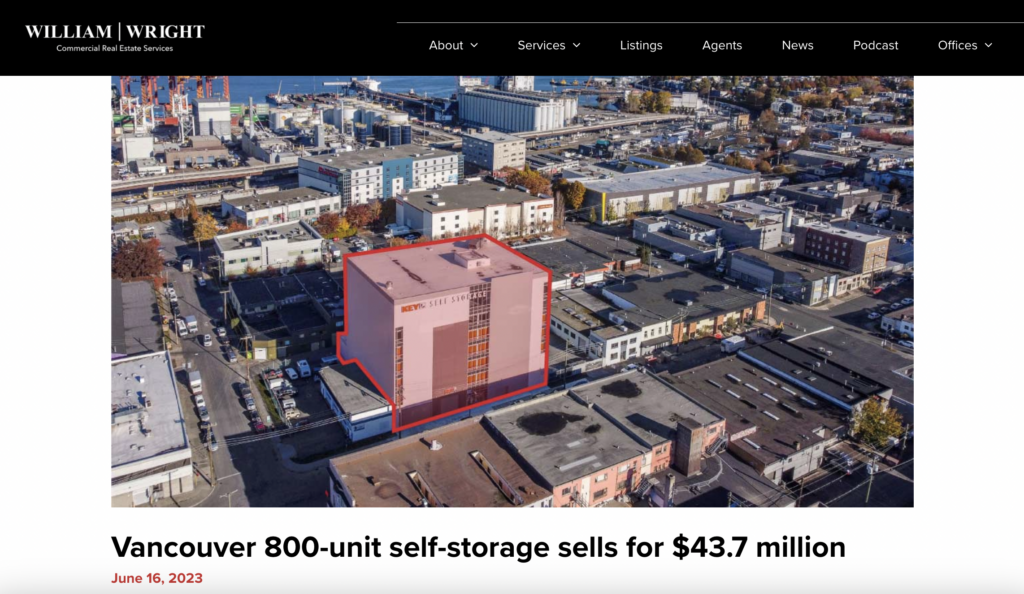

Self Storage Facilities

In recent years, self-storage facilities have become a hot investment niche with impressive returns. Unlike other commercial real estate, self-storage enjoys consistently high demand and occupancy rates. Customers also tend to stay for long periods of time, providing secure long-term income.

Newly constructed climate-controlled self-storage facilities in urban and suburban markets make the safest investments in 2023. These modern facilities can charge premium rental rates based on amenities like security features and climate control. Ideal locations will have a dense population, barriers to new development, and limited existing self-storage supply.

Check out this Recent self-storage that was sold for a whopping $43,700,000:

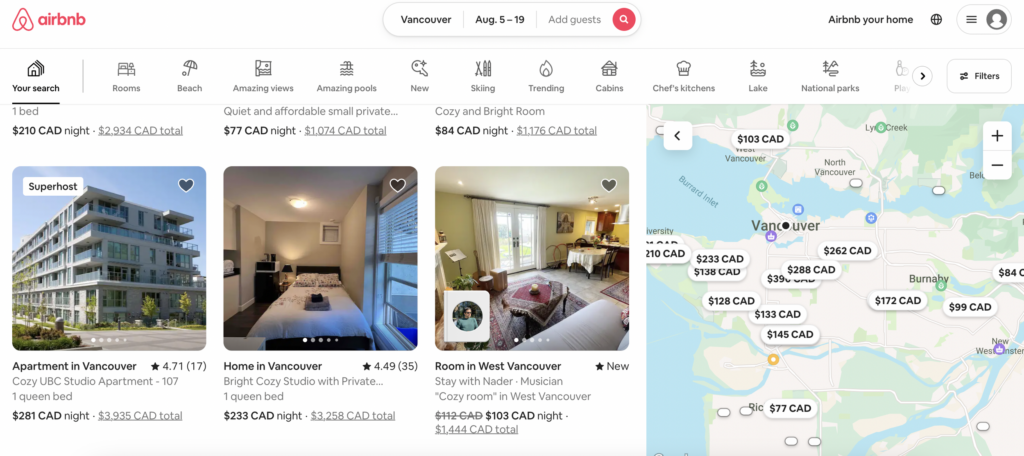

Vacation Rentals

Properties listed on sites like Airbnb and VRBO have become increasingly popular investments. Vacation rentals can earn significantly more per night than long-term rentals, while offering the convenience of short-term stays. Target vacation rental properties in popular tourist destinations.

Mixed-Use Buildings

Not only should you look into investing in a multifamily property, but you should also consider mixed-use buildings. These have become increasingly popular and profitable investments, especially in urban areas where land is limited. Combining residential, retail, and office spaces allows investors to appeal to a diverse mix of tenants.

Residential components like apartments benefit from strong rental demand in most markets and provide fairly stable income. Retail spaces can attract restaurants, cafes, and shops that add convenience and exposure for the property. Offices cater to small businesses, startups, and professional firms.

Blending these uses creates foot traffic and a built-in customer base for ground-floor retail. Residents enjoy living steps away from dining and entertainment. The right mix can help each space “feed” demand for the others.

With proper research and planning, the above property types can be lucrative additions to an investment portfolio in 2023. The key is finding properties poised for rent and value growth in sought-after areas that tenants will pay a premium for. However, rising interest rates in 2023 may impact financing and returns. It’s important to work with trusted commercial real estate experts to minimize risks and maximize gains.